Options trading offers a variety of strategies to manage risk and enhance potential returns. One such strategy is the Ratio Spread, which involves an unequal number of bought and sold options to create a position with limited risk and targeted profit zones. It can be used in both rising and falling markets, depending on the type selected, call or put.

When executed properly, it can provide attractive returns with strategic planning. In this article, we’ll discuss how ratio spreads work, their risks, and their rewards.

Understanding Ratio Spreads

A ratio spread is an advanced options strategy involving the purchase and sale of options contracts of the same type, either calls or puts, with the same expiration date but at different strike prices.

The key characteristic is the unequal number of contracts bought and sold, such as a 1:2 or 2:3 ratio. This approach aims to reduce upfront cost and potentially generate higher returns under specific market movements.

There are two primary forms: call ratio spreads, suited for mildly bullish scenarios, and put ratio spreads, used when anticipating limited downward price movement.

Risk vs Reward Analysis

Let’s see the risk versus reward of this strategy to truly understand whether it aligns with your market outlook and risk appetite.

1. Profit Potential

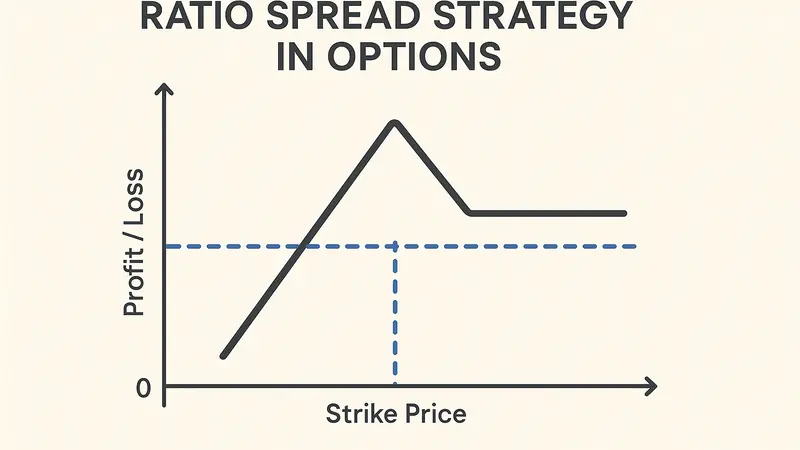

A ratio spread strategy aims to profit from a moderate move in the underlying asset’s price. In a call ratio spread, maximum profit is realized when the underlying asset’s price closes at the strike price of the short calls at expiration, as the sold options expire worthless while the long call gains value.

Similarly, in a put ratio spread, peak profit occurs when the price lands at the strike of the short puts. This allows the trader to collect a premium while benefiting from limited directional movement.

The setup performs best in low-volatility environments where sharp price swings are unlikely.

2. Risk Exposure

One of the critical challenges in advanced options strategies lies in managing risk exposure. In a call ratio spread, if the underlying asset’s price rises sharply beyond the short call’s strike price, the uncovered position can lead to unlimited losses.

Similarly, with a put ratio spread, a steep drop in the underlying asset’s value can result in substantial downside risk. These strategies require precise market forecasting and are suited for experienced traders.

Individuals seeking to understand and navigate such complexities can enrol in Upsurge.club’s option trading courses, which provide practical frameworks for minimizing exposure while maximizing strategic flexibility.

3. Breakeven Points

In options strategies involving uneven contracts, such as selling more options and buying fewer options, breakeven points determine the price at which a trader avoids loss.

For a call ratio spread, the breakeven is calculated by adding the net premium received (or subtracting the net debit) to the strike price of the short calls. For a put ratio spread, it’s the short put strike minus the net premium. These calculations help manage downside exposure.

Conclusion

The ratio spread strategy in options trading offers a way to earn profits with limited investment when the market moves slightly in the expected direction. However, if the market moves too much, it can lead to losses. Therefore, it’s important to use this strategy carefully, especially in stable markets, and to manage risks properly.

To learn more, you can consider enrolling in Upsurge.club’s option trading course for beginners.